The consequences of what is happening at the moment are inevitably affecting not only our way of living but the business as well. Even in turbulent times, we believe that it is important to gain as much as possible out of your funds. Now, when Europe is getting ready for loosening the measures of isolation and restarting its economy, we are sharing with you why now is the right time to invest in iuvo.

The case of Easy Credit

We would like to pay attention to the counter-cyclicality of the assets in iuvo during economic crises. The team of one of our main partners, and part of iuvo’s family – Easy Credit, shared statistics with us, that shows the dependency between the macroeconomic indicators in Bulgaria and the portfolio of our originator. Based on that, the analysists of the company are making their business development prognose for the rest of 2020.

Easy Credit’s portfolio and the nonbank crediting market in general, are marking a significant growth in periods of economic crisis. These periods are characterized with a decline in GDP and relative growth in unemployment. Therefore, the credit score of the potential borrowers decreases and they fall out of the target group of the banks, but fall in the segment of nonbank financial institutions, that have a special experience in scoring and working with such clients.

The focus of the research is on three periods in the past 15 years, that give us proof for this dependency:

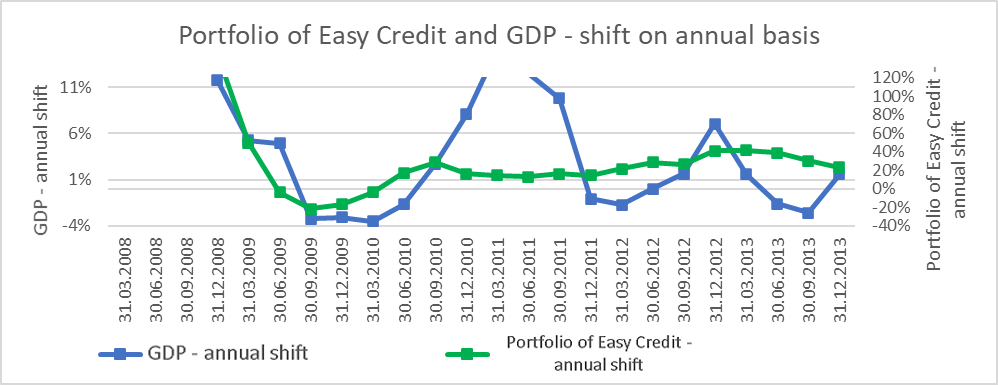

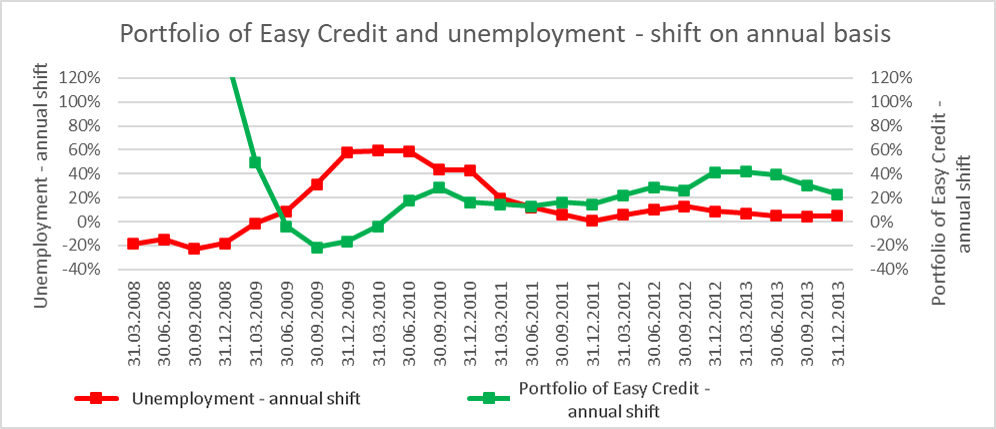

o The global financial crisis from 2008 came into Bulgaria in the end of 2009. In the Q3 period of 2009 till Q1 of 2010, the GDP of the country declines with around 3%. However, during that same period the portfolio of Easy Credit successfully resists the recession, and actually grows with 18% and 29% in Q2 to Q4 of 2010 (see graph 1). The relation between unemployment and the portfolio of the credit institution follows the same logic – the growing number of unemployed people increases the portfolio of the credit company – and respectively their income (see graph 2). We have to acknowledge that the economy of the country is in way better condition at the moment, and the government has the ability to transform these people into cost effective payers, than 10 years ago. This is one more reason to be optimistic.

o In Q4 of 2011 to Q1 of 2012, GDP declines with 2% on annual basis. We can see that there is growth in Easy Credit’s portfolio during the same period. In Q1, Q2, and Q3 of 2012, the portfolio of the company grows respectively with 22%, 29%, and 26%. Such growth is achieved during the previous economic crisis in Q3 of 2010. In the next three quarters, during relatively small GDP growth, the portfolio of the company reaches its highest growth rate for the last 5 years since its existence – average of over 40% annual growth for each trimester.

Graph 1:

Grpah 2:

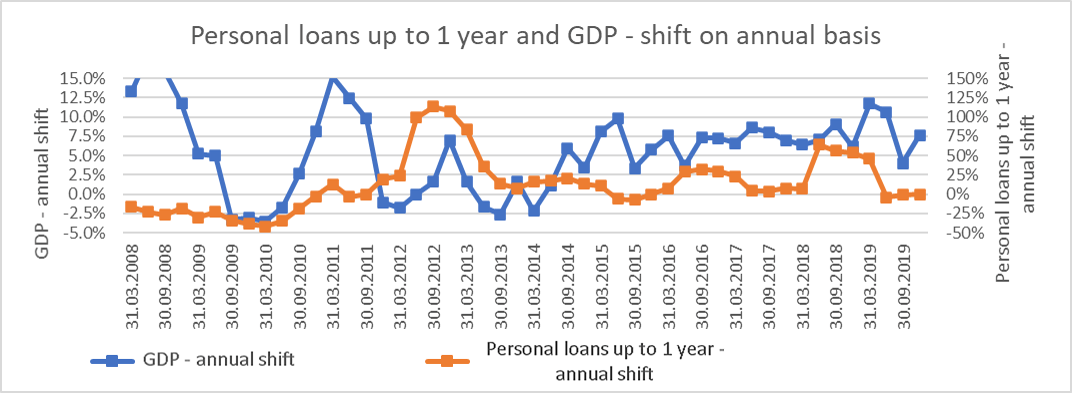

Graph 3:

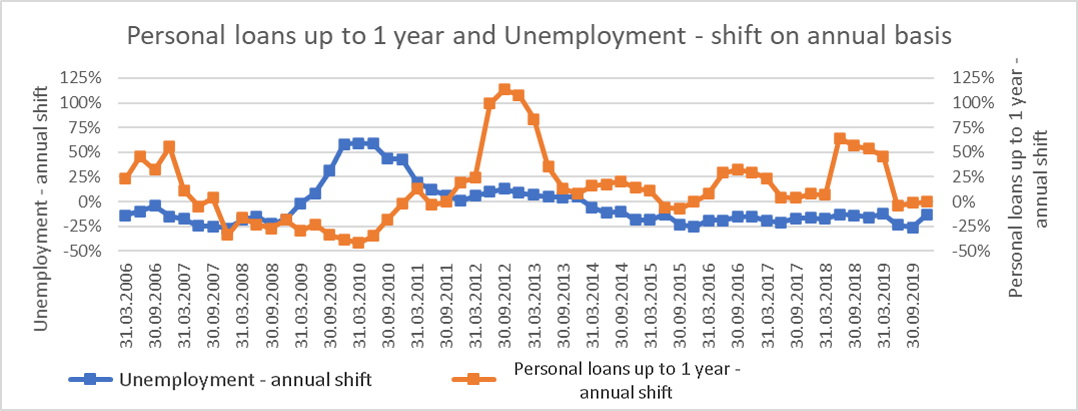

Graph 4:

Easy Credit has 15 years of experience behind its back in strong economy and in recession. Based on deep analysis with the data for this period, the team expects 25% and even 30% portfolio growth in the Q2 of 2020. This will probably happen with our other originators as well.

The economic crisis will create opportunities for higher yield. Now is the moment to increase the size of your invested funds and to take a look at your Auto Invest criteria. If you have any questions, please do not hesitate to reach out to us. Our team works at full speed, so you can be sure that we stay beside you.

Keep or increase your balance and stay an active investor in iuvo. Your invested funds will work for you and will bring you an average annual return of 9.2%, even in times of uncertainty. Each loan has a different return rate, duration, and parameters. The decision in what type of loans to invest is entirely yours. Take advantage of all opportunities, that iuvo provides you with, and be one step ahead.

en

en